Forfaiting Example

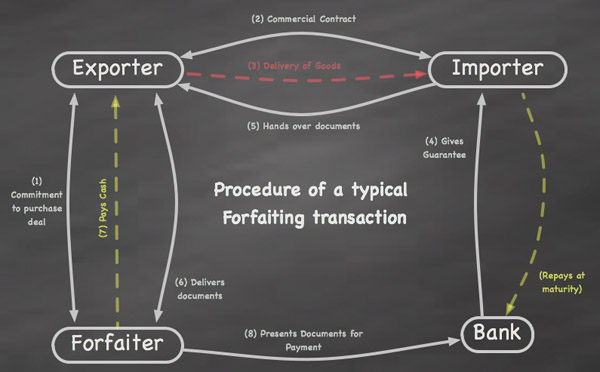

In order to illustrate how forfaiting takes place in practice, the following is a typical forfaiting transaction where the buyer and the seller of goods are located in different countries.

1. During the course of negotiations between an exporter and an importer for the supply of goods, the importer asks for credit terms.

2. The exporter approaches a forfaiter and asks for an indication of whether the forfaiter is willing to provide this credit and how much it is likely to cost. At this stage the forfaiter will need to know:

- The country of the importer

- The importer’s name

- The type of goods

- The value of the goods

- The expected shipment date

- The repayment terms sought by the importer

- Whether the importer’s obligations will be guaranteed by a bank, and if so, who?

3. The forfaiter provides the exporter with an indication of the costs involved. At this stage neither party is committed in any way.

4. When the details of the commercial contract have been agreed, but usually before it has been signed, the exporter asks the forfaiter for a commitment to purchase the debt obligations (bills of exchange, promissory notes etc) created under the export transaction.

5. The information required for this is the same as for an indication.

6. The forfaiter issues a commitment which is accepted by the exporter and which is binding on both parties (1). This commitment will contain the following points:

- The details of the underlying commercial transaction.

- The nature of the debt instruments to be purchased by the forfaiter.

- The discount (interest) rate to be applied, together with any other charges

- The documents that the forfaiter will require in order to be satisfied that the debt being purchased is valid and enforceable

- The latest date that the exporter can deliver these documents to the forfeiter

7. The exporter signs the commercial contract with the importer and delivers the goods (2+3).

8. In return, if required, the importer obtains a guarantee from his bank (4) provides the documents that the exporter requires in order to complete the forfaiting (5). This exchange of documents is usually handled by a bank, often using a Letter of Credit, in order to minimise the risk to the exporter.

9. The exporter delivers the documents to the forfaiter who checks them and pays for them as agreed in the commitment (6+7).

10. Since this payment is without recourse, the exporter has no further interest in the transaction. It is the forfaiter who collects the future payments due from the importer (8) and it is the forfaiter who runs all the risks of non-payment.